The trend of "tranquility" on European electricity exchanges remains unpredictable

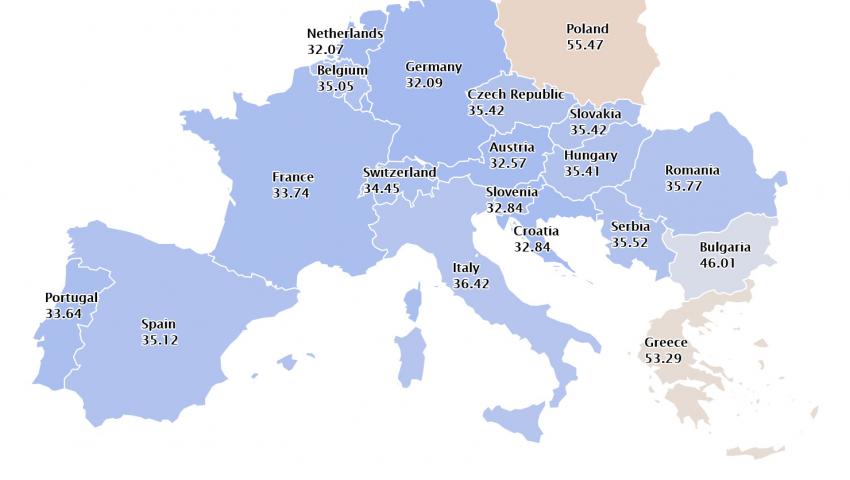

After the low prices over the weekend, the European electricity exchanges in the market segment "day ahead" started the new week with growth of 20.6% in the Netherlands (achieved price of 32.07 EUR / MWh), 40.3% in Bulgaria (achieved price of 46.01 3 EUR / MWh) and 174% in the Czech Republic and Slovakia (35.42 EUR / MWh). The first place in terms of price jump in percentage terms is held by the electricity exchange in Germany - 351.7% and the achieved price of 32.09 EUR / MWh with a delivery on October 5 compared to 7.11 EUR / MWh on October 4. Then a decrease of 56.8% was reported, according to energylive.cloud. In this connection, experts are increasingly beginning to pay attention to the very high volatility occupying the European electricity markets and most often manifested in the "market day ahead" segment.

At the same time, if you look at the statistics, it becomes clear that compared to the last ten days of September, when the stock market reached a price of 50 euros per MWh, prices are declining this week. For other electricity exchanges, such as Italy, they are within the values reached a year ago.

That is, for some of the electricity exchanges the trend of the wave of high prices is reversed. However, not quite for Bulgaria. The highest price achieved last week on the Bulgarian Independent Energy Exchange (IBEX) in the segment "market day ahead" has a delivery day of September 30, 52.72 euros per MWh. At present, it is noteworthy that compared to the levels achieved a year ago on the stock exchanges in Romania and Serbia, prices are relatively small, but this does not apply to stock exchanges in Greece and Bulgaria. Meanwhile, the fact that the value of the Greek exchange with a delivery day on October 5 remains quite high - 53.29 euros per MWh - cannot be ignored.

In Bulgaria last week the real change of the market started with the exit of the small companies and this is already evident in the traded quantities of the IBEX. More accurate statistics will become clear by the middle of the month, but the process will continue and this factor will certainly continue to influence in the future. The decommissioning of one of the units of Kozloduy NPP also has an indisputable influence. Meanwhile, this is evident in the intensity of carbon emissions. For example, according to the electricitymap.org carbon intensity rating (gCO₂eq / kWh), Bulgaria ranks 70th in the world with carbon emissions ranging from 384 g (gCO₂eq / kWh) to 324 g in the first days of October. In France, for comparison, they range from 65 to 34 g (gCO₂eq / kWh). As it is clear from the data on the exchanges, the prices of CO2 emissions for December are at the level of 26,970 euros per ton (decrease by 0.22%).

It seems too early to think of a tendency to break volatility and for calmer European electricity exchanges. Moreover, with the start of the "hydrogen future" the technical challenges will become even greater, prices at least in the short term more and more unattractive, and producers more and more restless. The electricity market, especially in the day-ahead market segment, remains the most dynamic.

Not to be overlooked is the deteriorating situation with the spread of the coronavirus. More and more European countries are introducing stricter restrictive measures, and analyses show that this is not having a good effect on the electricity market. This time there may be no closure of production, but the markets will also be affected, in particular the producers in the larger western countries are already starting to calculate their expectations. Meanwhile, the number of people infected as a result of the COVID-19 pandemic in the world already exceeds 35 million people.

Against this background, Europe seems shocked by the military conflict between Afghanistan and Azerbaijan. Undoubtedly, it has yet to make its most difficult decision, given the forthcoming launch of the Trans-Adriatic Pipeline at the end of the year, which is to transport Azeri gas to Europe. In this respect, it cannot ignore any involvement of Turkey. On its way to diversification, the European choice of Russian gas seemed very easy some time ago, but the current political situation around Turkey, and now around Azerbaijan, raises much more sensitive issues. In this seemingly world of chaos, strangely or not, each EU country must individually and jointly address issues concerning local and mass protests, which indirectly affect every consumer who tries to turn on a computer or lighting in their home.