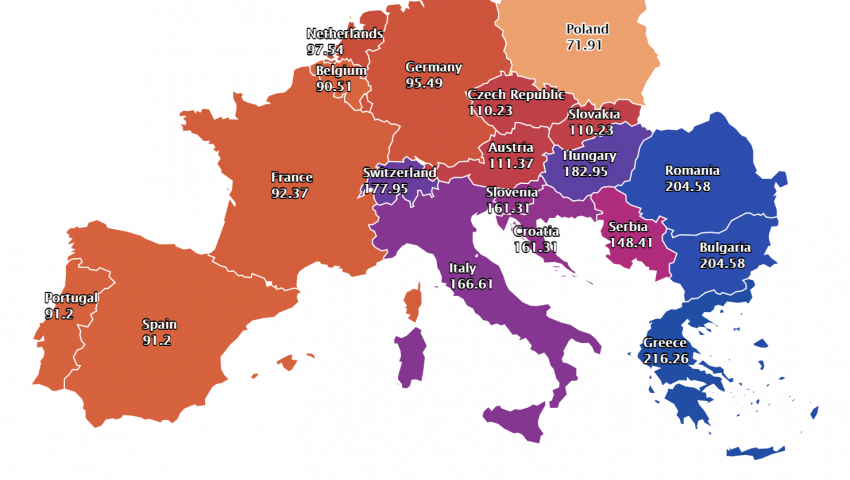

Greece, Bulgaria and Romania have the most expensive electricity in Europe

The prices of the European electricity exchanges in the "day ahead" segment calmed down and went down. Not in our country - electricity in Bulgaria is almost three times more expensive than in Poland!

Source: Energy Live

Marinela Arabadjieva

Fact. Electricity prices have calmed down. The tone was set by the oil, gas, coal and emissions markets. Moreover, after the long rally, coal, gas and oil reported a weekly loss. For oil, it was a drop for the first time in two months. For three consecutive days, a significant decline in gas values was observed. The price of CO2 futures also went down.

It is possible that the market will set a different tone with a delivery day on November 2, but it is a fact that the European electricity exchanges in the "day ahead" segment will start in November with values half lower than on the last Monday in October. With one clarification - on most European electricity exchanges (in the day-ahead segment). Neither Bulgaria, nor Romania, nor Greece rank among them.

The values in the day-ahead segment and on the electricity exchange in Hungary are also high. Against this background, even the electricity exchanges on the Iberian Peninsula and in Italy, which for a long time were record holders at high prices, fell by half compared to a week earlier.

In this sense, credit should be given to the measures proposed by the European Commission, which untied the hands of governments in fully liberalized electricity and gas markets, but proved difficult to apply to a regulated market in Bulgaria with a dominant power of BEH. Moreover, there is no way to ignore the fact that the caretaker government has in practice applied a model that it has criticized. When he came to power, the main criticism in the energy sector was directed at the double dividends paid to the state by the NPP, and now, although in a different way, the same is practiced with promises of compensation in time.

Prices

The first half of the last week of October definitely passed under the sign of anxiety and with prices closer to 200 euros per MWh. At the start with a delivery day on October 25, the values varied in a wide range - from 105.68 euros per MWh in Poland (EPEX SPOT) to 189.30 euros per MWh in Bulgaria (IBEX, IBEX). The electricity exchanges in Spain and Portugal (OMIE) reported values of EUR 225.36 per MWh. The limit reported on the electricity exchanges in Germany (173.65 euros per MWh) and France (206.44 euros per MWh) was also wide.

The highest price levels in the "day ahead" segment were reported with a delivery day on October 26, reaching 239.88 euros per MWh in Italy, and IBEX values rose to 219.43 euros per MWh.

Thanks to this strong jump, the decline in this segment of European electricity exchanges, which started with a delivery day on October 27, was not felt. On enough of them the value of over 200 euros per MWh remained, and on eight the prices reached over 220 euros per MWh.

The decline was still a fact, lasted until the end of the week. With this, the European electricity exchanges gave a clear signal that prices may go down and reach values that market participants had forgotten in the last month.

Wind, sun, demand and production of electricity

The first three days of last week, which passed under the sign of another upward trend in some markets, are the result of lower temperatures, lower wind power share - almost twice lower than a week ago and a corresponding decrease in the share of gas capacity in electricity generation. The shutdown of some of the nuclear refueling facilities is also having an impact. The influence of each of the sources has a different meaning for different markets.

The review shows that the decline that began at the end of last week has been established, and with a delivery date of November 1 in some countries already leads to a return to values reported before September and October 2021. However, this does not apply to electricity exchanges in the region. In particular, this applies to the electricity exchanges of Bulgaria and Romania. However, the unification in the "day ahead" segment with Romania started very recently. Preliminary expectations are that it will have a positive effect on downward price levels. Now the eyes are focused on the expected positive effect, but we must also take into account what is happening with the COVID-19 pandemic, which is at its peak in both countries.

As for the western markets, the sharp decline in gas in the energy mix is impressive, as with a delivery day on November 1, for example, the share of gas in Germany drops to only 3.8% and in France - 1.33%, which is not only due to reduced supply. gas through the Yamal-Europe gas pipeline, if earlier data are followed. It should be noted that the month of October, which passed under gas prices, has already taken enough "victims" among energy companies and reduce competition. Although the UK is not under consideration here, it is an example of this - 13 are energy companies that have gone bankrupt as a result of high gas prices, and at the end of last week the seventh largest company in the country was under threat. At the same time, however, investments in the network do not stop there, but there is another threat - the debts of the participants in the RES sector.

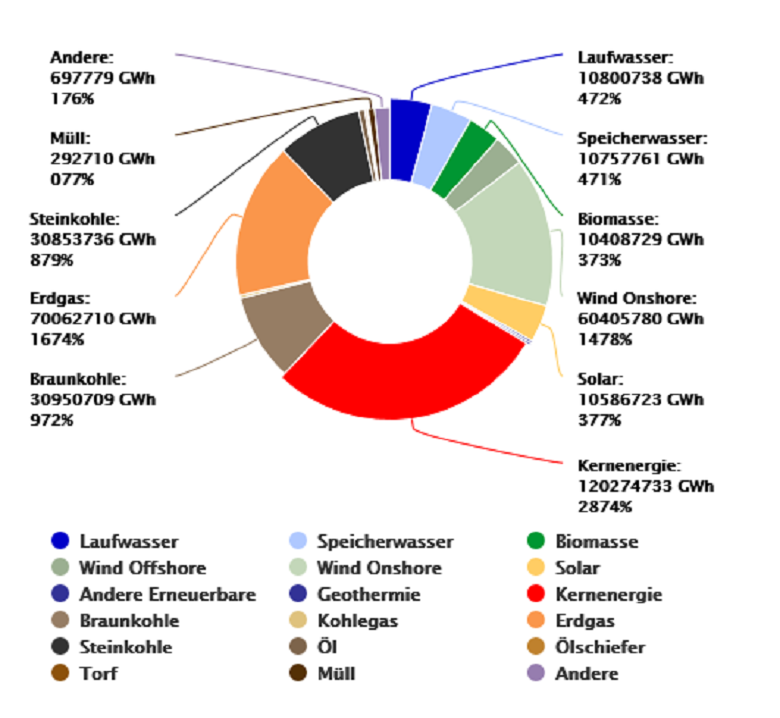

In general, the production of electricity from RES, NPPs and coal on the European electricity market is almost equal. According to the German platform Energy Charts, as of October 31, electricity production in Europe reached a volume of 43,724,468 GWh. The recovery of electricity demand for different markets varies from 1 to 5%.

Prices of oil, gas, CO2

Oil prices ended last week for the first time in a long time. After staying at $ 85-86 a barrel for a long time, December futures ended at $ 84.43 a barrel. The decline is a result of the expectation of the start of negotiations on the Iranian nuclear deal. The desire was launched quite actively by the United States, and leading negotiators from Iran and the European Union agreed to resume nuclear talks by the end of November after a three-month hiatus following the election of President Ebrahim Raisi. Successful negotiations will bring Iranian oil to market, and investors are already calculating their profits. Before that, the markets will follow the OPEC + meeting on November 4, and it is already clear that it is unlikely that it will be allowed to go beyond the already agreed quota to increase production by 400 thousand barrels per day.

As for gas prices on the TTF index on the ICE Futures exchange, it went down last week. Three consecutive days of decline affected both November and December futures. As a result, December futures on Friday ended at a price of 66,100 euros per MWh (still with a positive settlement). November futures, which most of the time managed to irritate the market with prices that managed to reach 116 euros per MWh, still showed that they can go down - up to 75.3 euros per MWh.

As for CO2 prices, they remained in the range of 59-58 euros per tonne.

Of course, it cannot fail to account for the collapse of Chinese coal futures traded on the Zhengzhou Stock Exchange, which recorded its biggest weekly decline in years, falling to CNY 970 per metric ton ($ 150 / t) after Beijing tightened pressure on coal prices.

Trends

Taming enthusiasm. In this way, the steps taken by the European institutions to try to stop the rise in prices can be determined. The European Commission has tried to summarize the views of different countries on the energy crisis. However, longer-term solutions can hardly be expected before the spring of 2022. If there are any, they will be under the sign of the future of blue fuel.

The transition period in which natural gas will play a leading role is only now beginning. In practice, Europe will have to confirm that the gas infrastructure into which millions of euros have been thrown will be properly designed. The enthusiasm of investors in solar and wind power must be equated with sensible plans for an energy transition that does not cause failures in high-intensity industries and taking into account the participation of other sources of clean energy.

It is no coincidence that gas market participants in Europe have also set requirements in terms of taxonomy, and if the EU institutions want to tackle the risks of future price spikes, they will have to look at the possibilities for a smooth transition. Probably the pressure of the nuclear industry for the inclusion of energy from nuclear power plants will also have to be taken into account.

Generally speaking, the European Commissioners are about to make sense of the enthusiasm of some nation states to change the energy model. In principle, the approach to which revolutionary proposals for longer-term contracts in the electricity market are pushing for the first time means that the foundations for turmoil can also be laid in the European political model, which has already laid other foundations.

Replacing the energy model with the current one with a new, less well-known one, as fast as some countries insist, can lead to deviations accessible only to certain strata and thus lead to a huge division and distortion of the "green deal.“

The promises made from the rostrum of the Glasgow Climate Summit will also have to be seen in this light.